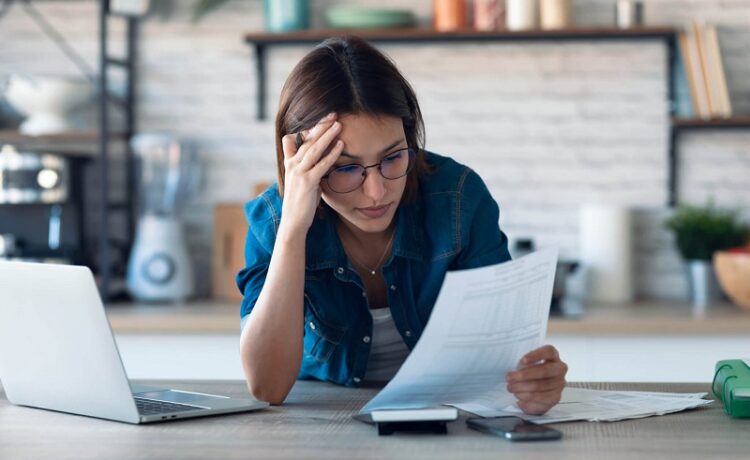

A person who is “living paycheck to paycheck” is one who, in the event of losing their employment, would be unable to meet their financial obligations. Most people who scrape by from paycheque to paycheque use their money to cover their numerous outlays. In contrast to those who have built up a savings cushion over the years, those who live paycheck to paycheck are more likely to be financially vulnerable in the case of an unexpected job loss. Now understand how to not live paycheck to paycheck.

Realising the Difficulty of Making Ends Meet

Although the term “working poor” is commonly used to describe those who depend from pay cheque to pay cheque, this may not be an accurate description of the scale of the problem since it affects people of varying socioeconomic statuses.

Those who are considered “working poor” typically have low skill levels and low incomes. They fit the bill well, as described. Minimum wage workers can acquire postgraduate degrees in highly technical fields, contrary to popular opinion. On the other hand, there are balancing factors that make it necessary to live paycheck to paycheck. These extenuating circumstances include things like industry-wide layoffs and a general lack of success in securing stable, skill-appropriate employment.

Plan Your Spending

If you want to stop surviving from one paycheck to the next, you’ll need to create a budget. Start by recording all of the transactions made with and withdrawals from your bank account. Add your monthly expenses to your reported income and see what you come up with. If your income fluctuates from month to month, you should divide your entire annual income from the preceding year by 12. A computer programme can calculate the sum for you, or you can use a calculator or write it out by hand.

Focus on the Crucial Details

Prioritising necessities like food, utilities, shelter, and transportation is a good place to start when creating a long-term budget. Include work-related necessities, as well as preventative measures like health insurance and regular doctor’s visits.

Factors to Take Into Account

The capacity to save money and avoid living paycheck to paycheck are both benefits of taking responsibility for one’s financial situation. Spending on a consistent basis may also involve luxuries rather than necessities. One’s ability to budget responsibly comes into doubt when such lifestyle-driven spending is considered a luxury. Increasing personal spending habits, on top of ongoing price inflation, makes it harder, if not impossible, for an individual to escape the trap of living paycheck to paycheck. If individual spending increases, the cycle may continue even if there are significant increases in income.